How to avoid getting scammed in 2023

How to avoid getting scammed in 2023. Use these important pointers to learn how to recognize scam indicators. We offer advice on how to stay safe from fraud in 2023.

They appear in face-to-face interactions as well as phone chats, emails, SMS messages, links shared by “friends,” and SMS messages.

How to avoid getting scammed:

You might become a victim of fraud practically anywhere, at any time. By enlightening you on how con artists operate and how they collect your payment information, we hope to give you the knowledge you need to spot scams before you lose money.

Spot fake messages and emails:

Scams are evolving significantly in sophistication. Don’t rely on bad language and spelling to identify one. Yes, there are still lots of frauds that use sloppy writing, poor grammar, and improper punctuation.

- However, there are many that are just as reliable as official statements made by well-known businesses, and create a fake

- a website that appears just like the actual thing is not that difficult.

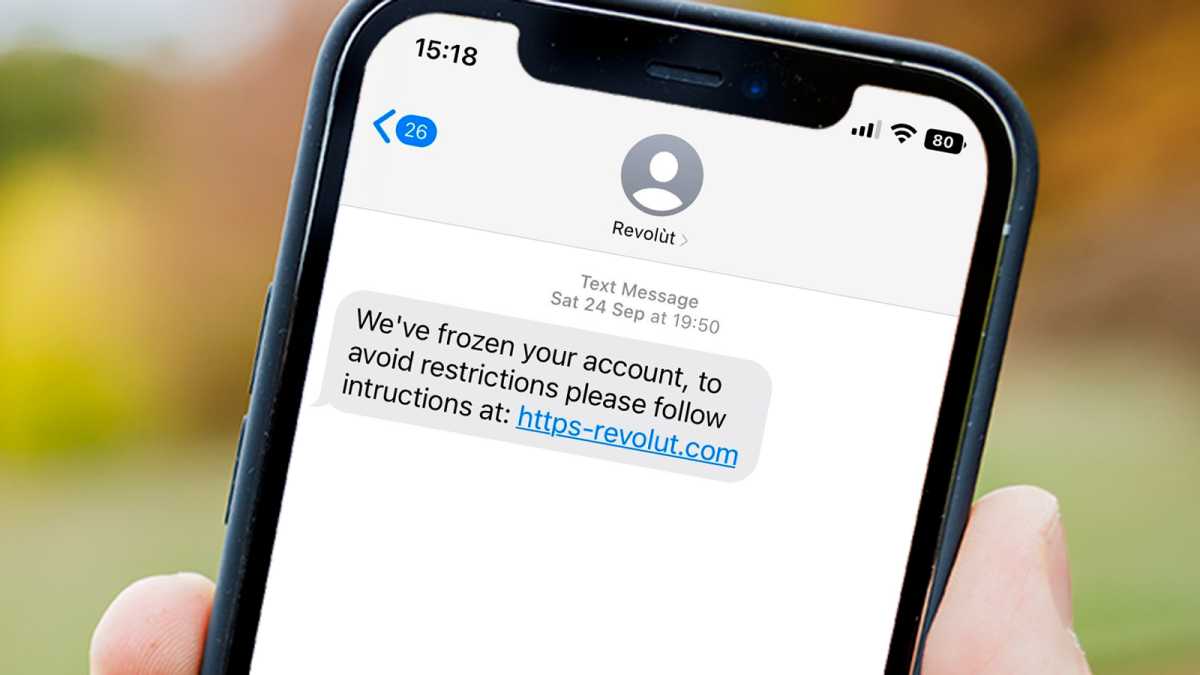

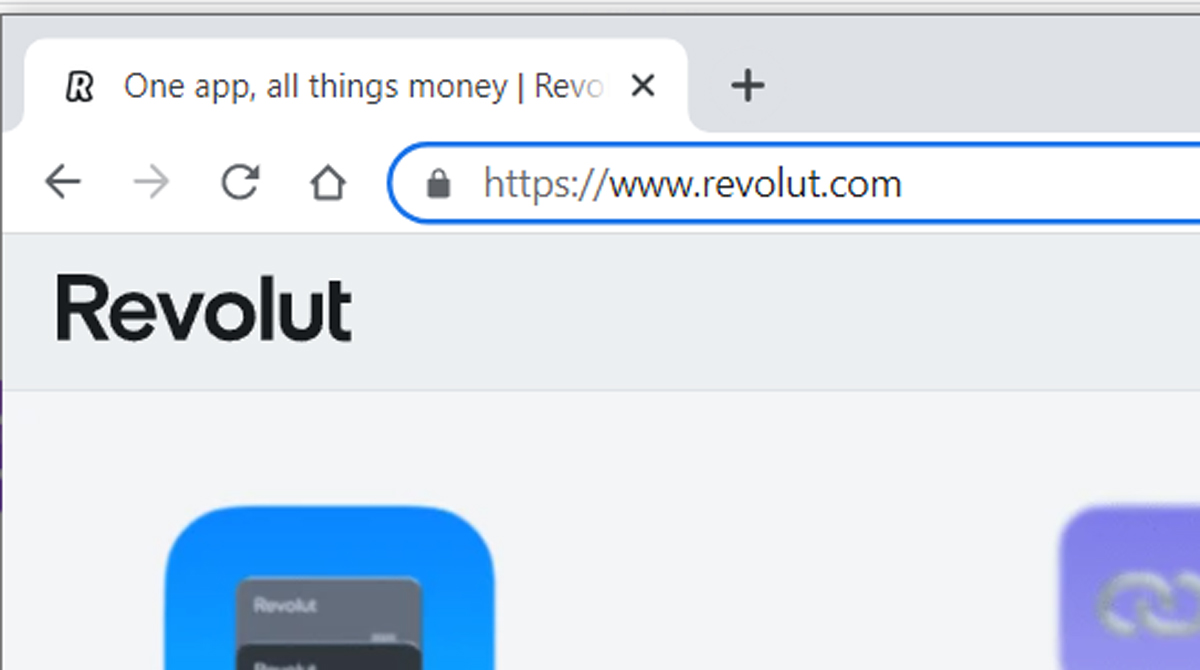

- Look at the URL, or site address, of any links in the message you are reading to see if it is a hoax.

- This is the quickest approach to determine if something you have received is a scam.

- Since they don’t have authority over the legitimate website and can’t utilize it to steal your information.

- The fraudsters are unable to use the legitimate URL. Instead, they will attempt to fool you by registering a name that sounds similar to yours.

The whole URL might not always display in web browsers, especially those on mobile devices, but you can always click or touch on it in the address bar to view it.

Read more: How to Setting up a new laptop and PC

Although it comes close to the actual thing, if you know what to look for, you can tell it’s not the real deal.

Don’t click on links or open attachments:

Avoid the temptation to tap or click on links that you aren’t convinced about. Before clicking on something, you can usually determine whether it is hazardous or not.

Additionally, many trustworthy security programs and applications these days will alert you if they find a risky link in an email or text message. Some people may accomplish this on social media feeds as well.

Don’t give out passwords or payment details:

- Be wary if you unexpectedly get a request for your bank account information, credit or debit card number, or any other sort of payment.

- Legitimate businesses and organizations never phone you out of the blue and demand your passwords or other personal information.

- A typical scam involves a person posing as your bank telling you there is a problem and that you need to verify (or re-check) your information.

- Therefore, if this occurs, whether over the phone, in person, by email, or in another manner, presume it is a scam and keep your mouth shut.

- Only when you phone a firm to discuss the specifics of a service or account should you be asked for information.

- Even then, they won’t request your password or bank information. You will never be prompted for the entire password; at most, one or two letters.

Don’t be pressured to act quickly:

Recently, we learned of a phone scam in the UK when con artists call victims while posing as police. They claim to be looking into fraud involving your bank account and require your confirmation of the information.

This is a tried-and-true pressure strategy to frighten you into compliance against your better judgment.

Scammers might also exert pressure on you by setting arbitrary deadlines that give you the impression that you must act right now.

You don’t, though. Checking to see if the request is legitimate should come first.

As previously said, contact the business or organization that is allegedly asking for

this information to ascertain if it actually came from them or not.

Ask your bank what is going on if someone claims that your account is frozen or that there is an issue with your bank (using their legitimate, official contact information).

Pay using a credit card:

If you weren’t satisfied with what you purchased, you can request a refund from the credit card company.

In the US, credit cards are more secure than other payment methods.

However, you may also utilize a technique that hides your card and bank information from the shop, like Apple Pay or Google Pay.

Read more: How to benchmark and speed test an Android phone

Check directly with the company in question:

- The best method to ensure that something has been delivered to you by a trustworthy corporation is to get in touch with them via legitimate channels.

- In other words, avoid contacting someone by phone or email using the information supplied in emails or links you’ve clicked.

- By using Google or simply entering the company’s website URL into your browser. you may get the company’s legitimate contact information.

- By confirming that the item you have was actually sent by the sender, you may determine if it is legitimate or not.

Don’t assume search results are safe:

Don’t merely click on a result in the mistaken belief that it is safe to use since Google or Microsoft Bing (actually, no one uses Bing) returned it.

Search engines should filter out the worst websites, but this does not imply that all of the websites they present are safe.

Security software might be helpful in this circumstance once again. The free internet browser add-on Norton Safe Web scans search results and flags those that it deems to be potentially dangerous.

4 Comments